World leading, AI-Driven Structured Finance Software and Risk Solutions Powering Global Finance

Innovative software and expert support that streamline administration and regulatory compliance across structured finance, securitization, ABCP, ABS, MBS, warehousing, covered bonds, significant risk transfer, fund finance, private credit, capital-call, and asset finance.

Circa 20%

of the world’s top 50 banks rely on our software solutions

$1+ Trillion

assets managed across our platforms globally

SOC II Type II and

ISO 27001 accredited

Why TAO Solutions?

For over a decade, TAO Solutions has helped global financial leaders drive growth, cut costs, and boost efficiency through technology, expertise, and service. Today, we support dozens of institutions, including ~20% of the world’s top 50 banks, managing $1T+ in assets, backed by SOC II Type II, ISO 27001 credentials.

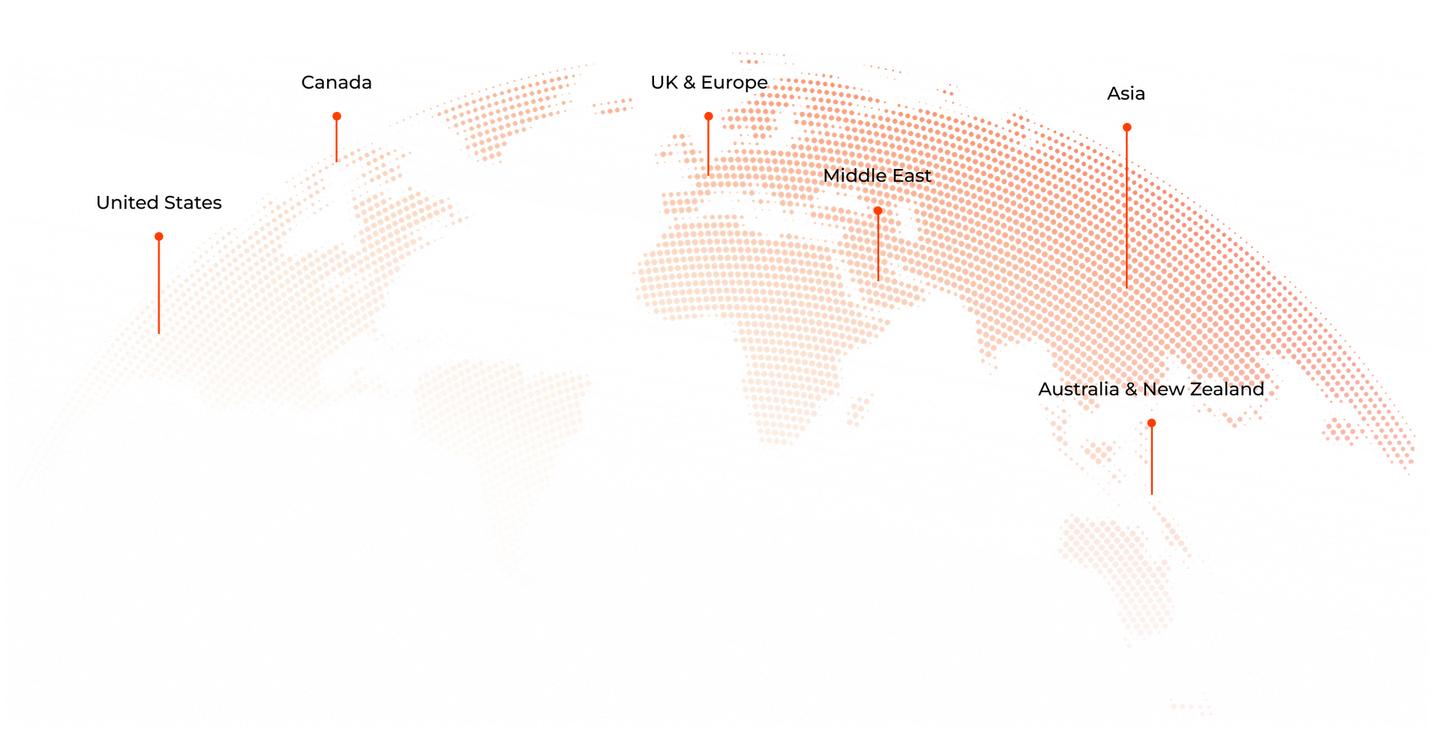

Headquartered in Toronto, Canada with operations in the US and Asia Pacific, TAO Solutions delivers world-leading structured finance, asset-backed securitization, mortgage-backed securitization, covered bond, asset-backed commercial paper, warehouse lending, fund finance, capital call, private credit administration software for the financial services industry.

Our Products

The global benchmark SaaS solution for securitization, structured finance, and ESG, serving issuers, lenders, conduits, trustees, and regulators.

A flexible SaaS/PaaS solution for end-to-end administration and regulatory reporting across jurisdictions and asset classes.

Canada's mortgage funding and portfolio management software as a service solution built for issuers and aggregators.

Representing the de facto standard for mortgage securitization, structured finance and covered bond SaaS software solutions in Canada.

LeaseSpark is a cloud SaaS application that improves the efficiency of your daily equipment finance operations, making it easier to originate, administer and manage deals throughout their lifecycle.

SCULPT by TAO Solutions automates complex asset selection and pool structuring, reducing execution time by 95% while ensuring perfect compliance and optimal outcomes.

Our Services

THIRD-PARTY ADMINISTRATION

Asset Management and Administration Services

TAO Asset Management and Administration (TAMA) supports financial institutions, lenders, asset managers, trustees, investors and originators as a trusted outsourced partner, ensuring complex structured finance and asset portfolios are administered accurately and in compliance with legal requirements.

Professional Services

Software development, hosting, implementations, project management as well as on-going support and maintenance is what we do best. TAO’s Professional Services credentials are an integral part of our value proposition, enabling customers to achieve optimal delivery outcomes and superior returns on investment.

Advantages of TAO Professional Services

- Dedicated account management

- Established track-record of success

- Global reach with offices and personnel located in key regions

- Exceptional experience with understanding the nuances involved in SaaS implementations

- Better results within shorter timeframes

- Supports both full-scale as well as hybrid implementation methodologies

- Effective at managing both internal and external stakeholders

- Utilizing industry best practices

- On-going training and support provided to enable customers to operate on a self-service basis

Global Securitization Platform

Our securitization platforms contain advanced, automated, administration processes that simplify the complexities of operational, regulatory and risk requirements on both a domestic and global scale.

By serving both established and emerging markets, our solutions enable market participants to adopt industry best practices seamlessly, without the time and expense of building a bespoke system in-house.

INTERNATIONAL EXPERIENCE & REACH

Technology Solutions for Today, Innovation for Tomorrow

Bringing Together Securitization and AI

We have redefined and simplified what securitization technology can deliver to all market participants. With a fit-for-purpose solution, our products not only meet the funding and administrative needs of market participants today, but are flexible enough to proactively tackle future requirements. TAO Solutions products enable institutional agility that support industry

best practices.

Securitization administration have long relied on inefficient manual processes. TAO Solutions was created to deliver purpose-built products that improve productivity, accuracy and governance across asset selection, reporting and processing.

AI (Artificial Intelligence) can play a significant role within structured finance, asset back commercial paper, securitization warehouses, covered bond programs and TAO Solutions is committed to providing appropriate tooling to support this evolving industry.

Supporting Multiple Use-Cases and Transaction Types

Providing cutting-edge software, on-going software development, hosting, professional services, third-party administration, as well as on-going support and maintenance is what we do best.

TAO’s 15+ year credentials are an integral part of our value proposition. We truly understand customer requirements, enabling us to provide innovative solutions that are not rigid and supportive of both small and large-scale implementations.

Specializing in end-to-end, automated, administration solutions, we solve for specific use cases whilst allowing customers the upside of introducing or integrating additional business processes over time. This represents a win-win, whereby scale, a dynamic industry may require customers to explore new funding programs.

Our platforms support a variety of transaction types in any jurisdiction: Covered Bond, MBS, ABS, SRT, ABCP, Warehouse Lender, Whole-Loan, Central Bank Repurchase Facility, Fund Finance, Capital Call and Private Credit.

Advantages of working with TAO:

Supporting complex regulatory requirements

Automation of workflow activities

Generating material operational efficiencies

Better results within shorter timeframes

Effectively managing both internal and external stakeholders

Lowering costs - sound ROI & whole of life ownership benefits

Exceptional experience with increased cyber security & operational risks

Establishing industry best practices throughout the transaction life cycle

Multiple deployment capabilities - hosted and installed on-premises

Compatible or PARTNERED WITH:

The TAO Solutions Story

The global financial services industry is increasingly referring to TAO Solutions to address their securitization administration needs. We solve for a variety of use cases, involving various transaction types. Find out more about how we are evolving the landscape through technology and introducing industry best practices.

SecureHub revolutionized our ABCP Conduit Administration operations

“TAO Solutions SecureHub has revolutionized our ABCP (asset-backed commercial paper) conduit operations by removing all of our manual Excel-based tasks and delivering straight-through automation involving front, middle and back office operations. As a result, we have significantly increased our levels of productivity, reduced costs, and materially diminished operational risk.”

- Managing Director of Structured Products, "Big 6" Canadian Bank

Clients We Support

Contact Us

For more information, please fill out the form below and we’ll be in touch shortly.

Contact Us

By submitting this form, I agree to receive communications from TAO Solutions in connection with my inquiry. My information will be processed in accordance with TAO Solutions' Privacy Policy.