TAO Newsletter May 2024: Unlock Insights & Stay Updated!

Unlocking Future Trends: TAO Solutions May 2024 Newsletter Insights

Welcome to our latest edition of the TAO Solutions newsletter, where we bring you the latest developments and trends from the world of structured finance / securitisation / asset finance software technology. From groundbreaking innovations to industry insights, we're here to keep you informed and inspired. In this issue, we'll explore the latest industry trend involving ABCP (Asset-Backed Commercial Paper) Conduits and the recent enhancements to our software. So sit back, grab your favorite beverage, and let's dive into the world of tech!

A message from our CEO

Dear Colleagues,

We warmly welcome you to the inaugural edition of the TAO Solutions newsletter. As we tirelessly advance and refine our products to align with the evolving needs of the global structured finance industry, we are pleased to offer you insight into our recent endeavours.

Within this issue, you will discover a comprehensive overview of the latest enhancements integrated into SecureHub, alongside insightful market commentary on the global ABCP sector, where we proudly maintain a leading technological position.

Amidst the dynamic landscape of innovation at TAO Solutions, we commit to delivering this newsletter to your inbox quarterly, ensuring you are kept abreast of our ongoing initiatives. Notably, our forthcoming projects will include the integration of artificial intelligence functionalities across our suite of products, aimed at streamlining your structured finance operations for optimal efficiency.

Should you wish to delve deeper into any of our latest developments, we invite you to engage with us directly or meet us at upcoming industry events, such as the Global ABS conference in Barcelona from June 4th to June 6th, 2024.

We highly value your time and trust that our newsletter will prove both pertinent and enlightening. Your feedback is invaluable to us as we strive for continuous enhancement.

Warm regards,

Renewed Optimism

With Q1 2024 behind us, the major takeaway from our discussions with clients, conference attendees and prospects is that of renewed optimism and that the capital markets are strong. There is a general sense that markets are stabilising, and in many respects improving, supported by necessary organisational charges to cater for long-term growth objectives.

Q: What does this mean for structured finance issuers, aggregators, ABCP conduit sponsors, structured finance warehouse providers and trustees?

A: Preparing and investing for the next stage of the credit cycle needs to begin now (as needed) to enable market participants to maintain competitiveness from an operational and risk management perspective.

This year, we are pleased to be working with a number of key industry participants to address the needs of a wide spectrum of use cases. This includes our crucial efforts towards assisting with emerging markets and providing technological solutions to support access to structured finance / covered bonds funding techniques. In addition, our world leading efforts involving ABCP Conduit administration activities continues to bear fruit,enabling issuers to automate a number of operational processes, increase the number of sellers and successfully manage key risks. From an issuer and aggregator perspective, we continue to invest in new product functionality across multiple jurisdictions inlight of the introduction of Artificial Intelligence.

Feature Article: ABCP Conduits Awakening the Sleeping Giant

Market Overview

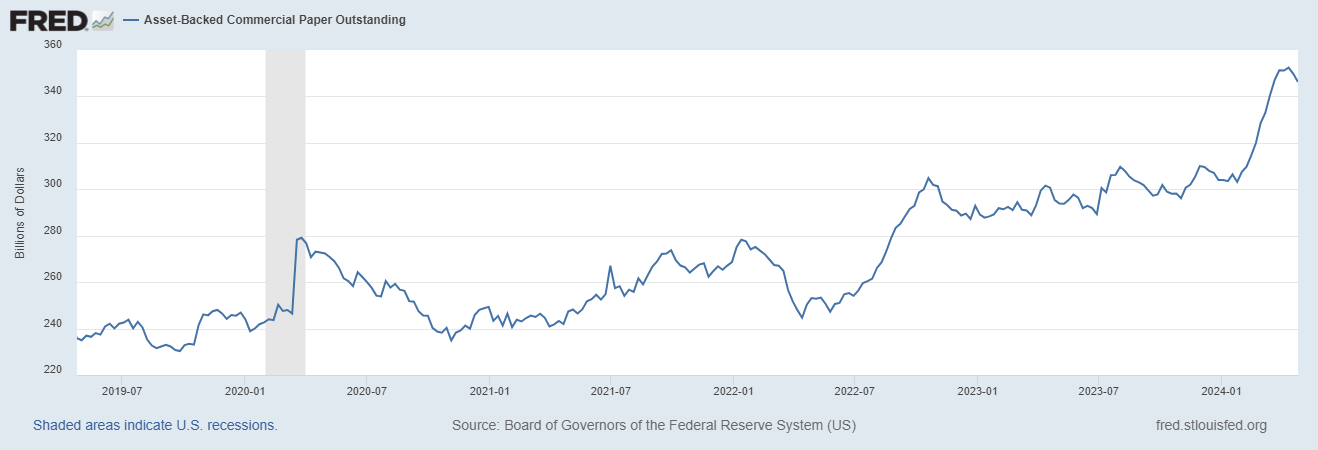

Relegated to backwater status after the Global Financial Crisis, Asset-Backed Commercial Paper (“ABCP”) outstanding has found its footing in 2024 establishing a decade high. The chart below as of April 24, 2024 from the Federal Reserve, illustrates the last five years of weekly aggregate US$ ABCP outstanding reaching US$352bn from a record low of $230bn in September 2019.Market Overview

Reasons for growth?

“We see growth in US ABCP outstanding in 2024 as a result of several factors”

says Jim Metaxas, Global Head of Sales at TAO Solutions. He Continues…

Upcoming Events

TAO Solutions will be exhibiting and participating in the upcoming Global Structured Finance and Securitization Events. This is a fantastic opportunity for you to meet our team and discover how our cutting-edge solutions can streamline your business processes, introduce industry best practices and address regulatory requirements. We look forward to seeing you there and sharing our insights.

Product Updates

We're excited to announce the latest enhancements and features in SecureHub. Our continuous efforts are aimed at enriching the functionality and capabilities of our technology and provide our global customers with industry-leading software. Listed below are examples included in the latest release:

- ABCP (CP Deals and Trades, Accounting, Configuration and Analytics)

- Engine Module Enhancements

- Accounting Journals Refactoring

- Staging Table Framework

- Regulatory Reporting (ESMA ANNEX 2 and BOE Loan Level Data Reporting)

Click here for the full details.

Case Studies

InfoHUB

©2025 TAO Solutions

Terms & Conditions | Privacy Policy | SOC 2 | ISO | Gold MS Partner | Accessibility